Fastener Distributor Index – May 2018

Written by R.W. Baird analyst David J. Manthey, CFA 6/7/18

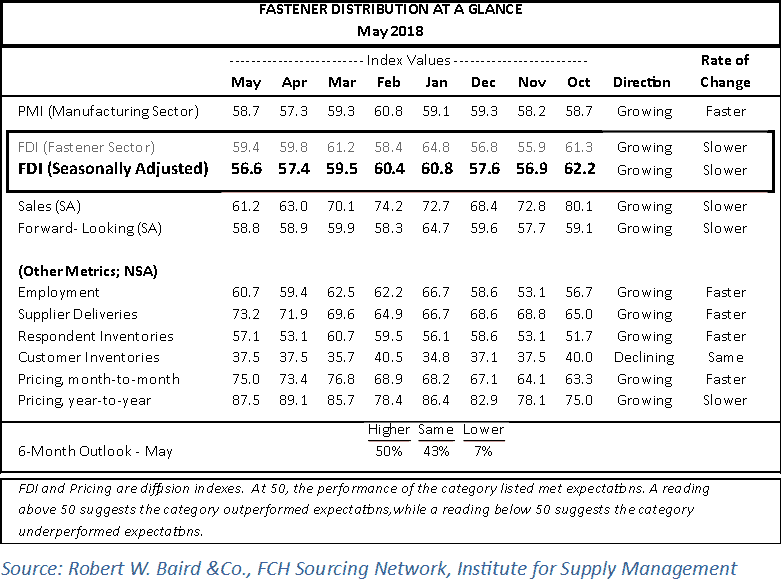

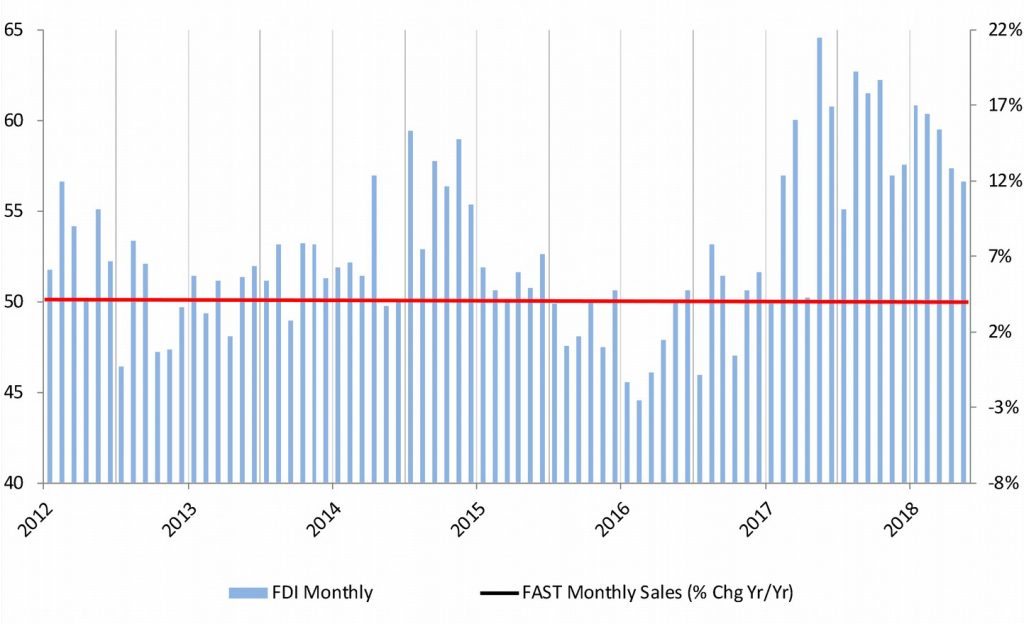

The seasonally-adjusted FDI for May 2018 was 56.6, continuing the YTD theme of a modest m/m deceleration, while still remaining well in expansionary territory. Selling conditions similarly moderated, with the seasonally-adjusted sales index coming in at 61.2 vs. 63.0 in April. Qualitative commentary on demand remains positive, and increasingly inflationary pressures from raw material increases/tariffs were again a common theme across respondent commentary. The six-month outlook remains strong overall, and the Forward-Looking Indicator was essentially unchanged m/m at 58.8 (April 58.9).Key Takeaway:

Key Points:

About the Fastener Distributor Index (FDI). The FDI is a monthly survey of North American fastener distributors, conducted with the FCH Sourcing Network, the National Fastener Distributors Association, and Baird. It offers insights into current fastener industry trends/outlooks. Similarly, the Forward-Looking Indicator (FLI) is based on a weighted average of four forward-looking inputs from the FDI survey. This indicator is designed to provide directional perspective on future expectations for fastener market conditions. As diffusion indexes, values above 50.0 signal strength, while readings below 50.0 signal weakness. Over time, results should be directly relevant to Fastenal (FAST) and broadly relevant to other industrial distributors such as W.W. Grainger (GWW) and MSC Industrial (MSM).

May FDI down slightly. The seasonally-adjusted May FDI (56.6) moderated m/m vs. April’s 57.4 reading, consistent with YTD trends (fourth straight month of deceleration, albeit off of a very high 60.8 January reading to start the year). In the May survey, 54% of respondents indicated sales were “better” relative to seasonal expectations vs. 56% in April. This produced a seasonally adjusted sales index of 61.2 (April 63.0). Pricing gains were again noted by a large majority of respondents, with 75% of respondents seeing higher prices y/y (and 50% m/m) vs. 81% in April. For perspective on the strength of pricing in May – only 20% of respondents reported higher pricing at the low point in March of 2016. The resulting FDI pricing index of 87.5 came down just slightly off of April’s record 89.1 reading. Several respondents again commented on inflationary pressures in the channel, with one comment indicating material distributors are seemingly using tariffs to justify price increases even on products not affected by tariffs. Regarding customer inventories, a majority of respondents continue to view inventory levels as in line with expectations (68% of responses), 29% believe customers’ inventories are too low, and just 4% see inventory levels as too high. This was fairly consistent with April (63% in line, 31% too low, and 6% too high).

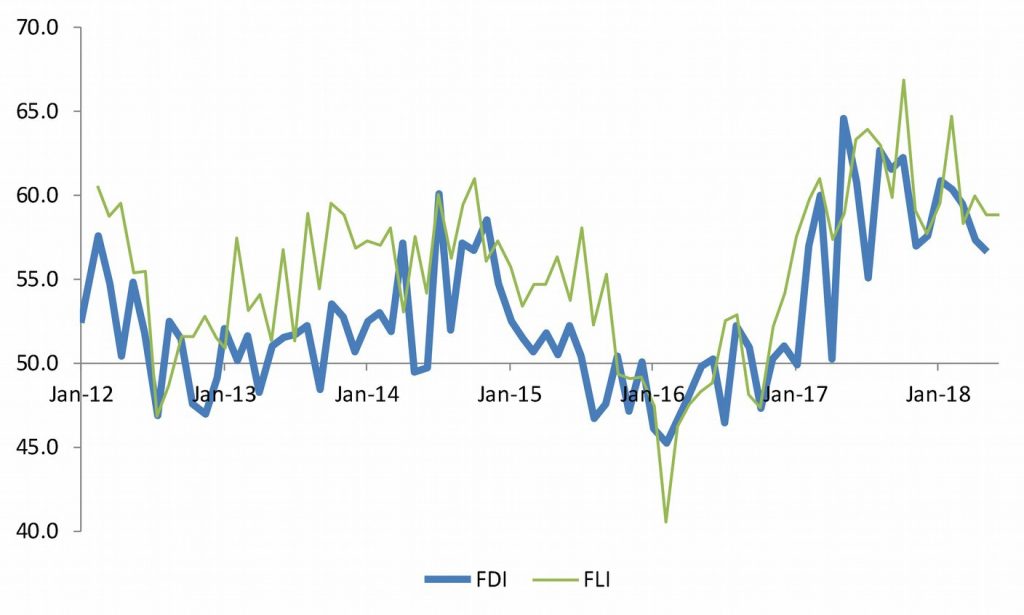

May FLI steady m/m. The seasonally-adjusted FLI was essentially unchanged m/m, registering 58.8 in May vs. 58.9 in April, as a slightly better employment index was offset by a modestly lower six month outlook. At 58.8, the FLI remains well into expansionary territory and is only slightly below averages seen across 2017 (60.9). Given solidly-expansionary FDI and FLI readings, we believe market conditions are likely to remain in growth mode (albeit potentially moderating growth) in the coming months.

Manufacturing employment improves slightly. Hiring sentiment improved this month among survey respondents. 32% of respondents saw higher employment levels in May relative to seasonal expectations vs. 19% in April, while 57% saw employment as in line (April 81%). The resulting FDI Employment Index was 60.7, up vs. April’s 59.4 reading. The May US jobs report was similarly better than expected with +223,000 jobs added (+188,000 expected) and the unemployment rate ticked down to 3.8% (3.9% expected), an 18 year low. May’s largest gains were registered in retail trade, health care, and construction. Manufacturing employment continues to trend upwards (+18,000 jobs in May), with most of the gains again coming from durable goods manufacturing (machinery +6,000). Total manufacturing jobs added over the past year now stands at +259,000, with 75% of the growth coming from durable goods industries. Average hours per work week for manufacturing employees decreased slightly at 40.8 hours (vs. April 41.1).

May sentiment mostly positive. Commentary from respondents skewed positive overall again this quarter. According to several participants, demand remains strong, with one respondent indicating “open orders are up 39% compared to last year at this time.” Another distributor highlighted construction as a particularly strong end market, saying “Watch the markets on cement companies and contractors. Their demand is going way up nationwide. Time to get in!” Steel tariffs and global trade remain topics of heavy discussion in the industry. One respondent indicated that they “still [have] concerns over the Chinese tariffs if they go through!” Inflationary pressures from raw material increases and steel/aluminum tariffs are increasingly evident in the channel. One distributor commented on this by saying, “Material prices in general are up, and some material distributors may take advantage of the situation and raise other material prices not subject to tariffs [i.e.] brass.” Quantitatively, survey data points to sustained momentum expected through 2018, with 50% of respondents expecting higher activity levels over the next six months and 43% expecting similar activity.

Fastenal reported May daily sales growth of 12.5% y/y, above our 11.5% estimate and again reflecting growth in all end markets/product lines. Underlying “core” growth (excluding foreign exchange) was 12.0%, the twelfth straight month of double-digit growth. Fasteners again saw strong growth at 9.1% y/y. Based on FDI data and other research inputs; we expect continued strength in public industrial distributor growth during 2018, with Fastenal y/y daily sales growth expected to remain in the double- digits through yearend.

Risk Synopsis

Fastenal: Risks include economic sensitivity, pricing power, relatively high valuation, secular gross margin pressures, success of vending and on-site initiatives, and ability to sustain historical growth.

Industrial Distribution: Risks include economic sensitivity, pricing power, online pressure/competitive threats, global sourcing, and exposure to durable goods manufacturing.

Fastener Distribution Trends: May 2018

Fastener Distributor Index (FDI); Seasonally Adjusted

Source: Robert W. Baird & Co., FCH Sourcing Network, company reports

1-Month Lagged FDI vs. FLI (Both Seasonally Adjusted)

Source: Robert W. Baird & Co., FCH Sourcing Network

Appendix – Important Disclosures and Analyst Certification

Covered Companies Mentioned

All stock prices below are as of 6/7/2018.

Fastenal Company (FAST-$52.36-Outperform)

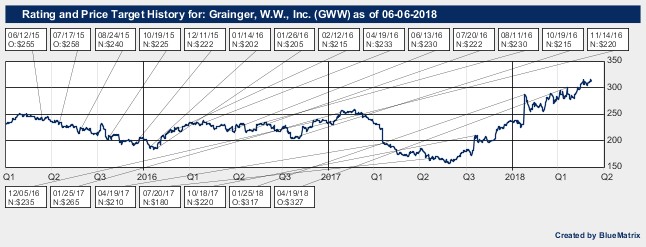

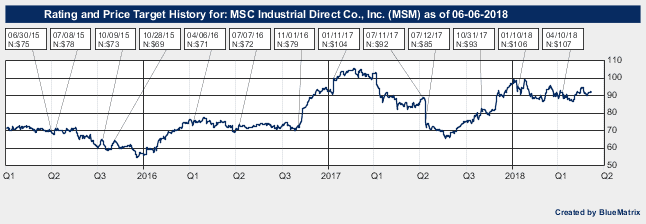

W.W. Grainger Inc. (GWW-$312.23-Outperform) MSC Industrial Direct Co. Inc (MSM-$92.15-Neutral) (See recent research reports for more information)

Robert W. Baird & Co. Incorporated makes a market in the securities of FAST, GWW, and MSM.

Robert W. Baird & Co. Incorporated and/or its affiliates have been compensated by Fastenal Company for non- investment banking-securities related services in the past 12 months.

Robert W. Baird & Co. Incorporated and/or its affiliates have been compensated by MSC Industrial Direct Co., Inc. for non-investment banking-securities related services in the past 12 months.

Robert W. Baird & Co. Incorporated (“Baird”) and/or its affiliates expect to receive or intend to seek investment- banking related compensation from the company or companies mentioned in this report within the next three months. Baird may not be licensed to execute transactions in all foreign listed securities directly. Transactions in foreign listed securities may be prohibited for residents of the United States. Please contact a Baird representative for more information.

Investment Ratings: Outperform (O) – Expected to outperform on a total return, risk-adjusted basis the broader

U.S. equity market over the next 12 months. Neutral (N) – Expected to perform in line with the broader U.S. equity market over the next 12 months. Underperform (U) – Expected to underperform on a total return, risk-adjusted basis the broader U.S. equity market over the next 12 months.

Risk Ratings: L – Lower Risk – Higher-quality companies for investors seeking capital appreciation or income with an emphasis on safety. Company characteristics may include: stable earnings, conservative balance sheets, and an established history of revenue and earnings. A – Average Risk – Growth situations for investors seeking capital appreciation with an emphasis on safety. Company characteristics may include: moderate volatility, modest balance- sheet leverage, and stable patterns of revenue and earnings. H – Higher Risk – Higher-growth situations appropriate for investors seeking capital appreciation with the acceptance of risk. Company characteristics may include: higher balance-sheet leverage, dynamic business environments, and higher levels of earnings and price volatility. S – Speculative Risk – High growth situations appropriate only for investors willing to accept a high degree of volatility and risk. Company characteristics may include: unpredictable earnings, small capitalization, aggressive growth strategies, rapidly changing market dynamics, high leverage, extreme price volatility and unknown competitive challenges.

Valuation, Ratings and Risks. The recommendation and price target contained within this report are based on a time horizon of 12 months but there is no guarantee the objective will be achieved within the specified time horizon. Price targets are determined by a subjective review of fundamental and/or quantitative factors of the issuer, its industry, and the security type. A variety of methods may be used to determine the value of a security including, but not limited to, discounted cash flow, earnings multiples, peer group comparisons, and sum of the parts. Overall market risk, interest rate risk, and general economic risks impact all securities. Specific information regarding the price target and recommendation is provided in the text of our most recent research report.

Distribution of Investment Ratings. As of May 31, 2018, Baird U.S. Equity Research covered 686 companies, with 59% rated Outperform/Buy, 40% rated Neutral/Hold and 1% rated Underperform/Sell. Within these rating categories, 12% of Outperform/Buy-rated and 6% of Neutral/Hold-rated companies have compensated Baird for investment banking services in the past 12 months and/or Baird managed or co-managed a public offering of securities for these companies in the past 12 months.

Analyst Compensation. Research analyst compensation is based on: (1) the correlation between the research analyst’s recommendations and stock price performance; (2) ratings and direct feedback from our investing clients, our institutional and retail sales force (as applicable) and from independent rating services; (3) the research analyst’s productivity, including the quality of such analyst’s research and such analyst’s contribution to the growth and development of our overall research effort; and (4) compliance with all of Baird’s internal policies and procedures. This compensation criteria and actual compensation is reviewed and approved on an annual basis by Baird’s Research Oversight Committee. Research analyst compensation is derived from all revenue sources of the firm, including revenues from investment banking. Baird does not compensate research analysts based on specific investment banking transactions.

A complete listing of all companies covered by Baird U.S. Equity Research and applicable research disclosures can be accessed at http://www.rwbaird.com/research-insights/research/coverage/research-disclosure.aspx. You can also call 800-792-2473 or write: Robert W. Baird & Co., Equity Research, 777 E. Wisconsin Avenue, Milwaukee, WI 53202.

Analyst Certification

The senior research analyst(s) certifies that the views expressed in this research report and/or financial model accurately reflect such senior analyst’s personal views about the subject securities or issuers and that no part of his or her compensation was, is, or will be directly or indirectly related to the specific recommendations or views contained in the research report.

Disclaimers

Baird prohibits analysts from owning stock in companies they cover.

This is not a complete analysis of every material fact regarding any company, industry or security. The opinions expressed here reflect our judgment at this date and are subject to change. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

ADDITIONAL INFORMATION ON COMPANIES MENTIONED HEREIN IS AVAILABLE UPON REQUEST

The Dow Jones Industrial Average, S&P 500, S&P 400 and Russell 2000 are unmanaged common stock indices used to measure and report performance of various sectors of the stock market; direct investment in indices is not available. Baird is exempt from the requirement to hold an Australian financial services license. Baird is regulated by the United States Securities and Exchange Commission, FINRA, and various other self-regulatory organizations and those laws and regulations may differ from Australian laws. This report has been prepared in accordance with the laws and regulations governing United States broker-dealers and not Australian laws.

Other Disclosures

The information and rating included in this report represent the research analyst’s views based on a time horizon of 12 months, as described above, unless otherwise stated. In our standard company-specific research reports, the subject company may be designated as a “Fresh Pick”, representing that the research analyst believes the company to be a high-conviction investment idea based on a subjective review of one or more fundamental or quantitative factors until an expiration date specified by the analyst but not to exceed nine months. The Fresh Pick designation and specified expiration date will be displayed in standard company-specific research reports on the company until the occurrence of the expiration date or such time as the analyst removes the Fresh Pick designation from the company in a subsequent, standard company-specific research report. The research analyst(s) named in this report may, at times and at the request of clients or their Baird representatives, provide particular investment perspectives or trading strategies based primarily on the analyst’s understanding of the individual client’s objectives. These perspectives or trading strategies generally are responsive to client inquiries and based on criteria the research analyst considers relevant to the client. As such, these perspectives and strategies may differ from the research analyst’s views contained in this report.

Baird and/or its affiliates may provide to certain clients additional or research supplemental products or services, such as outlooks, commentaries and other detailed analyses, which focus on covered stocks, companies, industries or sectors. Not all clients who receive our standard company-specific research reports are eligible to receive these additional or supplemental products or services. Baird determines in its sole discretion the clients who will receive additional or supplemental products or services, in light of various factors including the size and scope of the client relationships. These additional or supplemental products or services may feature different analytical or research techniques and information than are contained in Baird’s standard research reports. Any ratings and recommendations contained in such additional or research supplemental products are consistent with the research analyst’s ratings and recommendations contained in more broadly disseminated standard research reports. Baird disseminates its research reports to all clients simultaneously by posting such reports to Baird’s password-protected client portal, https://bol.rwbaird.com/Login (“BairdOnline”). All clients may access BairdOnline and at any time. All clients are advised to check BairdOnline for Baird’s most recent research reports. After research reports are posted to BairdOnline, such reports may be emailed to clients, based on, among other things, client interest, coverage, stock ownership and indicated email preferences, and electronically distributed to certain third-party research aggregators, who may make such reports available to entitled clients on password-protected, third-party websites. Not all research reports posted to BairdOnline will be emailed to clients or electronically distributed to such research aggregators.

To request access to Baird Online, please visit https://bol.rwbaird.com/Login/RequestInstLogin or contact your Baird representative.

United Kingdom (“UK”) disclosure requirements for the purpose of distributing this research into the UK and other countries for which Robert W. Baird Limited holds a MiFID passport.

The contents of this report may contain an “investment recommendation”, as defined by the Market Abuse Regulation EU No 596/2014 (“MAR”). This report does not contain a “personal recommendation” or “investment advice”, as defined by the Market in Financial Instruments Directive 2014/65/EU (“MiFID”). Please therefore be aware of the important disclosures outlined below.

Unless otherwise stated, this report was completed and first disseminated at the date and time provided on the timestamp of the report. If you would like further information on dissemination times, please contact us. The views contained in this report: (i) do not necessarily correspond to, and may differ from, the views of Robert W. Baird Limited or any other entity within the Baird Group, in particular Robert W. Baird & Co. Incorporated; and (ii) may differ from the views of another individual of Robert W. Baird Limited.

For the purposes of the FCA requirements, this investment research report is classified as investment research and is objective. This material is only directed at and is only made available to persons in the EEA who would satisfy the criteria of being “Professional” investors under MiFID and to persons in the UK falling within Articles 19, 38, 47, and 49 of the Financial Services and Markets Act of 2000 (Financial Promotion) Order 2005 (all such persons being referred to as “relevant persons”). Accordingly, this document is intended only for persons regarded as investment professionals (or equivalent) and is not to be distributed to or passed onto any other person (such as persons who would be classified as Retail clients under MiFID).

All substantially material sources of the information contained in this report are disclosed. All sources of information in this report are reliable, but where there is any doubt as to reliability of a particular source, this is clearly indicated. There is no intention to update this report in future. Where, for any reason, an update is made, this will be made clear in writing on the research report. Such instances will be occasional only.

Please note that this report may provide views which differ from previous recommendations made by the same individual in respect of the same financial instrument or issuer in the last 12 months. Information and details regarding previous recommendations in relation to the financial instruments or issuer referred to in this report are available at https://baird.bluematrix.com/sellside/MAR.action.

Robert W. Baird Limited or one of its affiliates may at any time have a long or short position in the company or companies mentioned in this report. Where Robert W. Baird Limited or one of its affiliates holds a long or short position exceeding 0.5% of the total issued share capital of the issuer, this will be disclosed separately by your Robert W. Baird Limited representative upon request.

Investment involves risk. The price of securities may fluctuate and past performance is not indicative of future results. Any recommendation contained in the research report does not have regard to the specific investment objectives, financial situation and the particular needs of any individuals. You are advised to exercise caution in relation to the research report. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Robert W. Baird Limited and Robert W. Baird & Co. Incorporated have in place organisational and administrative arrangements for the prevention, avoidance, and disclosure of conflicts of interest with respect to research recommendations. Robert W. Baird Limited’s Conflicts of Interest Policy, available here, outlines the approach Robert W. Baird Limited takes in relation to conflicts of interest and includes detail as to its procedures in place to identify, manage and control conflicts of interest. Robert W. Baird Limited and or one of its affiliates may be party to an agreement with the issuer that is the subject of this report relating to the provision of services of investment firms. Robert W. Baird & Co. Incorporated’s policies and procedures are designed to identify and effectively manage conflicts of interest related to the preparation and content of research reports and to promote objective and reliable research that reflects the truly held opinions of research analysts. Robert W. Baird & Co. Incorporated’s research analysts certify on a quarterly basis that such research reports accurately reflect their personal views.

This material is strictly confidential to the recipient and not intended for persons in jurisdictions where the distribution or publication of this research report is not permitted under the applicable laws or regulations of such jurisdiction.

Robert W. Baird Limited is exempt from the requirement to hold an Australian financial services license and is regulated by the FCA under UK laws, which may differ from Australian laws. As such, this document has not been prepared in accordance with Australian laws.

Copyright 2018 Robert W. Baird & Co. Incorporated

This information is prepared for the use of Baird clients and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the express written consent of Baird. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion, or information contained in this information (including any investment ratings, estimates or price targets) without first obtaining expressed permission from an authorized officer of Baird.

****

Fastener Distributor Index, Uncategorized